Investing in Silver

Like many other investors, you may have considered investing in silver or already hold silver. Like gold, silver is considered a long-term investment and a portfolio diversifier. The precious metal is incorporated in investment portfolios as a safety net against market volatility, and utilised as a safe haven from currency devaluation and economic uncertainty.

As a testimony to the above – at the time of writing this article – the silver chart on Kitco.com showed that silver has increased by 220.71% over the last 20 years.

Simply put, silver and other precious metals such as gold, are integral to a well-balanced investment portfolio.This is because precious metals perform well in volatile markets and do not correlate with traditional asset classes, and thus serves as a preservation of wealth.

Ways to Invest in Silver

There are a number of ways to invest in silver, thereby gaining access and exposure to the benefits of the precious metal. These methods include silver ETFs, mining company shares, silver derivatives, silver futures, unallocated or pooled accounts, and mutual funds.

However, these are all options to buy paper silver. The real benefits of investing in silver comes from purchasing and holding physical silver, which is separated from the fluctuations and determinations of the stock market.

Compared to other precious metals like gold, silver is generally more affordable and therefore an easier way to enter into the precious metals market. You can purchase physical silver in the form of silver bullion, silver coins, silver ingots or even by the gram. But how can you make sound decisions when it comes to buying and selling silver?

Gold and Silver Ratio

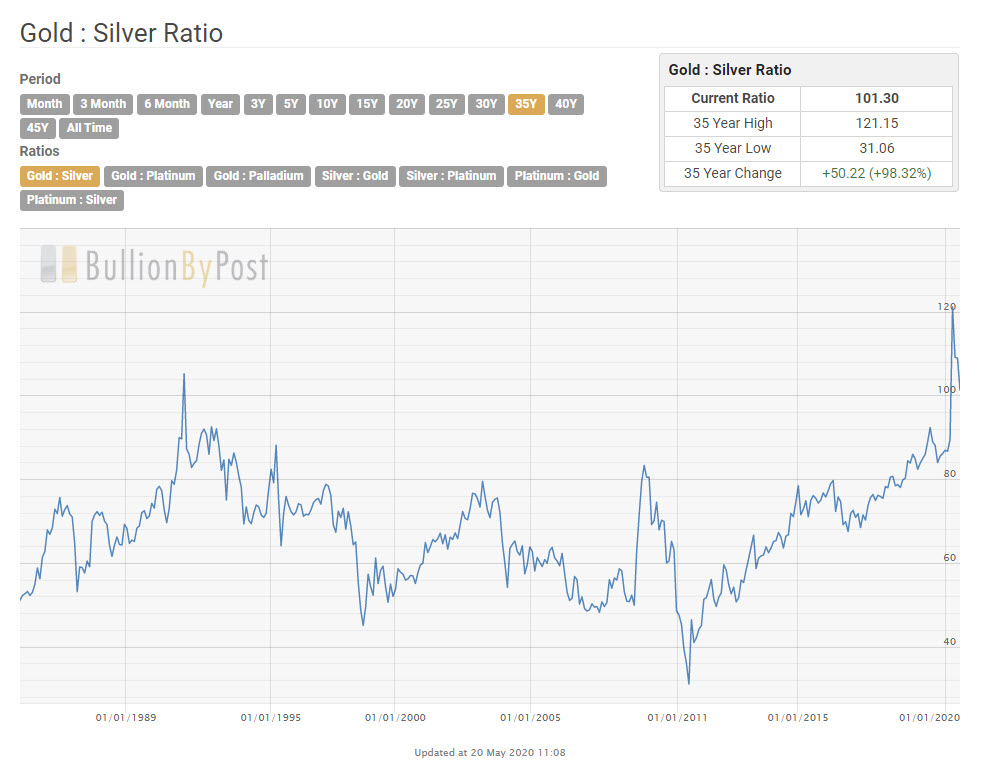

A popular tool used by investors is the gold to silver ratio. As explained by Investopedia.com, “The gold/silver ratio represents the number of ounces of silver required to purchase one ounce of gold. Investors use the fluctuating ratio to ascertain the relative value of silver compared to gold. This comparison allows the trader to determine the optimal time to purchase one metal over the other. It also helps investors diversify their precious-metal holdings.”

The gold/silver ratio is important to mention, as this indicator has been the topic of much discussion lately. In a recent article, the Economic Times asked the commodities guru, Jim Rogers which commodity he would invest in if he could only choose one.

Mr Rogers said silver would be his choice. He explained that, “If you look at the ratio of silver and gold, it is the highest it has ever been in recorded history. Never in history has silver been this cheap compared with gold… if I had the option, I would own silver just because it is cheaper.”

Furthermore, trading based on the gold/silver ratio is considered by many as a trusted strategy for accumulating these precious metals. If you look at the chart below you will see that recently the gold/silver ratio climbed to 101.3:1. This means that 101.30 ounces of silver are needed to purchase one ounce of gold.

But how may you apply the gold/silver ratio to your investment strategy? Considering the above example, the current ratio is relatively high when compared to historical data. While these figures will continue to fluctuate, an opportunity has presented itself.

By comparing the current ratio to historical data, you may expect the ratio to increase or decrease and eventually normalise. If you are expecting the ratio to decrease, you have the chance to trade an ounce of gold for 101.3 ounces of silver.

If the ratio decreased to, say the 35-year low of 31.06 ounces of silver to an ounce of gold, you would then be able to purchase just over three ounces of gold using your silver, thereby increasing your total holdings of gold – and vice versa when your aim is to increase your holdings of silver.

Purchasing Silver is Simple and Easy

In essence, compared to gold silver is a more affordable way to enter the precious metals market, and the precious metal has become readily accessible via a range of innovative products.

Silver is a highly liquid asset that you can buy and sell anywhere in the world; and unlike currency, silver can not be readily reproduced. Today it is easy to invest in gold and silver, and adding to or selling your silver is simple. You can purchase and sell back to retailers and online traders instantly, based on the spot price.

If you’re new to silver investment, Private Vaults Australia is here to answer any questions you may have about buying silver bullion and other products. PVA is a secure safe deposit box facility and gold and silver bullion dealer servicing the Sunshine Coast and Brisbane region.

For more info on investing in silver, contact PVA or read the PVA blog for more interesting news, tips and ideas to guide you.

2 Months Free, No long term commitment necessary.* Limited spots available.

Recent Comments